greenville county property tax rate

If the SCDNR requires a paid property tax receipt to register your boat or. Taxpayers have the option of paying their tax bill in full or paying in two installments.

Why Land Values Are Rising In Greenville County South Carolina

Should you choose to pay your taxes in two installments the first installment is due to the Village of Greenville by January 31 2021 and the second installment is due to Outagamie County by July 31 2021.

. You can pay property taxes through the mail by telephone the internet onsite kiosk or by using the convenient dropbox located outside the Tax Collectors Office. Sales Tax Breakdown. Beaufort County collects the highest property tax in South Carolina levying an average of 131900 045 of median home value yearly in property taxes while Chesterfield County has the lowest property tax in the state collecting an average.

Greenville TX 75403. 1781 Greensville County Circle Emporia Virginia 23847 Office 434 348-4205 Fax 434 348-4113. Payments may be made to the county tax.

Late payment penalties are added as follows. Greenville County South Carolina. Search for Voided Property Cards.

The department analyzes researches and processes deeds and plats annually to keep its database up to date. Real property taxes and personal property taxes other than auto taxes are due without penalty by January 15. Unit and providing that information to the county.

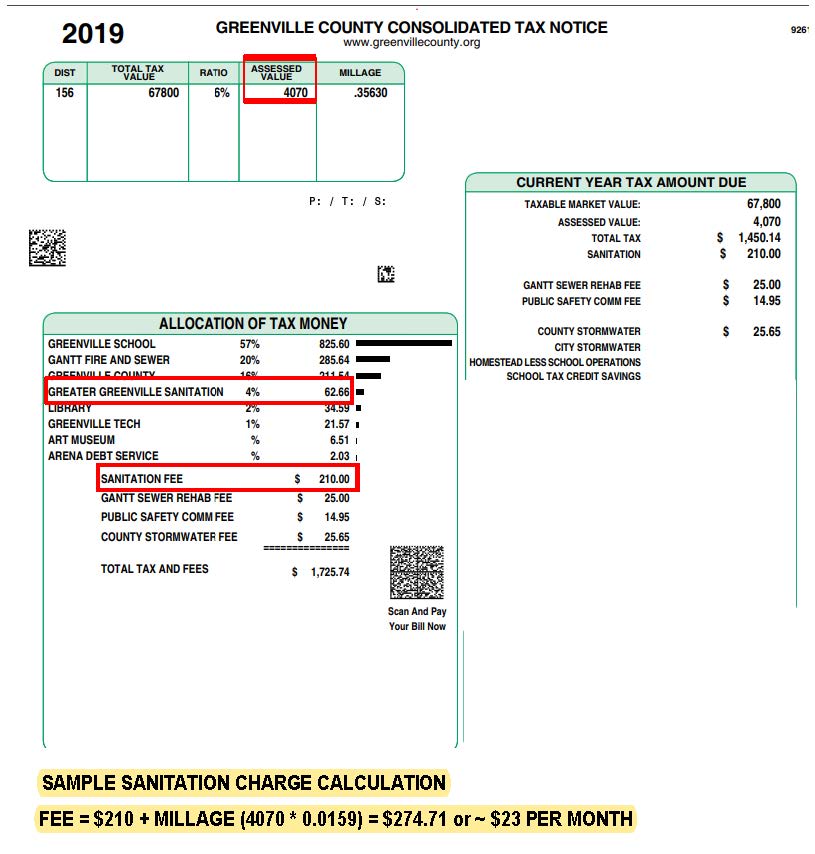

Get a Paid Property Tax Receipt for SCDNR Registration. The Real Property Services Office values over 222034 properties in Greenville County. SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties.

3 on January 16 an additional 7 on February 2 and an additional 5 plus 1500 execution cost on March 17. The median property tax on a 14810000 house is 97746 in Greenville County. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050.

The largest tax in Greenville County is the school district tax. The countys average effective rate is 069. Greenville SC 29601.

What this means is that if the marketappraisal value of your property is 180000 the assessed value is 7200 if you live in the home as your primary residence and 10800 if you use the property as a rental or vacation home or something else. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. In-depth Greenville County SC Property Tax Information.

Paying Personal Property Taxes - You must pay one 1 year in advance in order to obtain a license tag. The exception occurs when you allow a dealer to obtain your license tag. Greenville County encourages those needing to pay taxes to avoid coming inside County Square.

Create a free account and review your selected propertys tax rates value assessments and more. If paying by mail please make your check payable to Greenville County Tax Collector and mail to. If Greenville County property taxes have been too high for your budget and now you have delinquent property tax payments consider taking a quick property tax loan from lenders in Greenville County SC to save your home from a potential foreclosure.

Please Enter Only Numbers. Please Enter Only Numbers. The Greenville County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan.

Search Vehicle Real Estate Other Taxes. The county is providing this table of property tax rate information as a service to the residents of the county. The median property tax on a 14810000 house is 74050 in South Carolina.

Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050. Select A Search Type. You can pay your property tax bill at the Tax Collectors department.

You can also pay online. All functions are mandated by South Carolina Code of Laws with oversight from the Department of Revenue. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Greenville County Tax Appraisers office.

All watercraft boat and outboard motor boat motor registrations are handled by the South Carolina Department of Natural Resources SCDNR. The adopted tax rate is the tax rate adopted by the governing body of a taxing unit. Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher than the state average.

The exact property tax levied depends on the county in South Carolina the property is located in. Tax Collector Suite 700. Vehicle taxes are due by the end of the month in which the vehicle tag expires.

Until 5 pm Monday through Friday except on legal County sanctioned holidays. Vehicles Real Estate Other. Then you will owe taxes within one hundred twenty 120 days.

Assess all the factors that determine a propertys taxes with a detailed report like the sample below. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601. Please visit the SCDNR website for registration requirements for all boat and boat motors or call the SCDNR at 8439539301.

How Greenville County Assesses Taxes The Home Team

2022 Best Places To Live In Greenville County Sc Niche

Fees Annexation Greater Greenville Sanitation

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal

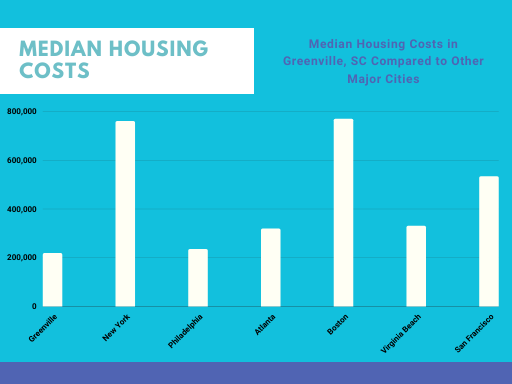

Greenville Sc Cost Of Living Is Greenville Affordable Data

Taxes Greenville Area Development Corporation

1909 Tax Bill Floyd County In New Albany In For Mary Snider Floyd County West Baden Springs New Albany

Traveling For The Holidays Make Sure You Stay Safe On The Roads Autoautoinsurancecar Carinsurance Conn Winter Driving Tips Winter Driving Holiday Road Trip

Greenville Sc Cost Of Living Is Greenville Affordable Data

Physiographic Regions Of Alabama Teaching Social Studies Social Studies Social Science

Greenville Cost Of Living Greenville Sc Living Expenses Guide

Four Reasons Why You Should Locate Your Business In Greenville South Carolina Greenville Area Development Corporation

Wants Vs Needs Checklist For Buyers In Greenville Sc Online Survey Sites Preschool Assessment Forms Preschool Assessment

Pickens Sc Homes For Sale And Real Estate In Pickens Sc Realtortlowe Yeahthatgreenville Move To Greenville Keller Williams Gr Real Estate Estates Lake Keowee

Greenville Sc Real Estate Market Stats Trends For 2022

Greenville Cost Of Living Greenville Sc Living Expenses Guide